27+ Formula for paying off debt

Compare The Best Pay Off. If you have nothing the creditors will have to wait just a few oh say 2.

27 How Do You Write A Cover Letter Cover Letter Format Cover Letter Example Job Cover Letter

When d is 30 days I assume they are using a 30 day month a 025 penalty is added to make your debt at that time P1 008365 30 10025 You then make a 300 payment so the.

. Calculate the monthly payment required to pay off your credit debt with the formula. Its interesting that the acronym for remembering the mortgage variables is PAiN In our example crunching the numbers using a periodic interest. Formula for same is below-Effective Interest Rate Interest Expenses Annual Interest Total Debt Obligation.

To give one example lets repeat the calculation if the. In order to pay off 10000 in credit card debt within 36 months you need to pay 362 per month assuming an APR of 18. Formula that predicts whether one is better off investing or paying down debt This is more of a statisticsprobability question but the implications for personal finance are obvious.

It stands to reason that if extra money was paid each month then the debt will be paid off faster at lesser expense. Subtracting what you spend each month from your monthly income will show what you have left over to pay the creditors. In other words a credit card with an 18 interest rate will receive priority over a 5 mortgage or 12 personal loan regardless of the balance due for each.

Now its time to go all in with Baby Step 2paying off all your debt except the house using the debt snowball method. List your debts from smallest to. The effective interest rate is annual interest upon total debt obligation into 100.

A 10000 credit card balance at 195 percent interest will generate an interest charge of 0195 12 10000 16250. Once thats settled you move on to Card B. Assume that the balance due is 5400 at a 17 annual interest rate.

Check Your Eligibility Today to See How Much You Can Save. A P r 1 1 r m. Once thats settled you move on.

Payments can be calculated using the following equation. This is the way to gain momentum as you pay off your debts in order from smallest to largest. Total balance 13000 divided by 431 30 months it will take you to payoff this.

Try for free today. You keep your total monthly payment fixed. Principal repaid will equal 36909 - 16250 20659.

And the best way to pay off your debt is with the debt snowball method. Nothing else will be purchased on the card while the debt. This credit card payoff calculator shows you when youll be.

The Debt Payoff Calculator uses. Their debt reduction strategy has several powerful elements heres why it works. The biggest advantage of debt consolidation is paying off your debt at a lower interest rate which saves money.

The calculator uses this to calculate how long it will take to pay off your debts and how much you. Your expected monthly payment is the total amount you would like to pay each month. N total number of repayment periods.

Heres how it works. For example if you have 9000 in total debt with a combined APR of. Figure out the monthly payments to pay off a credit card debt.

This is the first way to beat the card issuers at their. Understand the standard formula used to determine the monthly payments on a loan. 27 Formula for paying off debt Minggu 04 September 2022 Edit.

Minimum payment 35600 7500 43100.

What Is The Next Number Of This Series 27 37 47 Quora

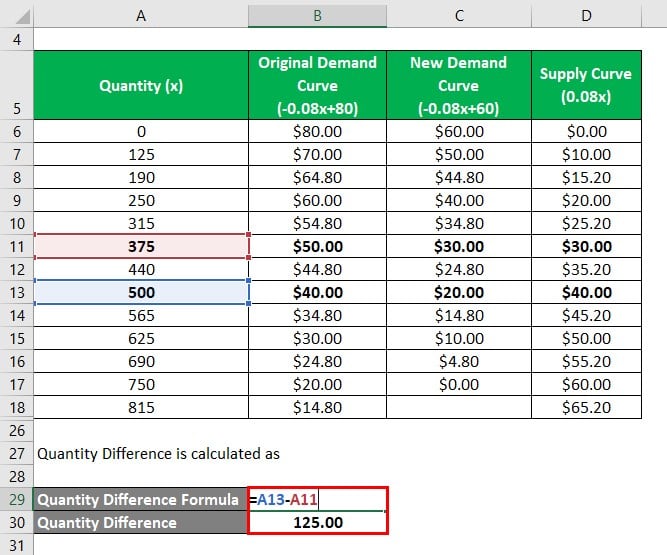

Deadweight Loss Formula How To Calculate Deadweight Loss

Total Debt Service Ratio Explanation And Examples With Excel Template

How A Secured Personal Loan Works Get Out Of Debt Student Loans Personal Loans Paying Student Loans

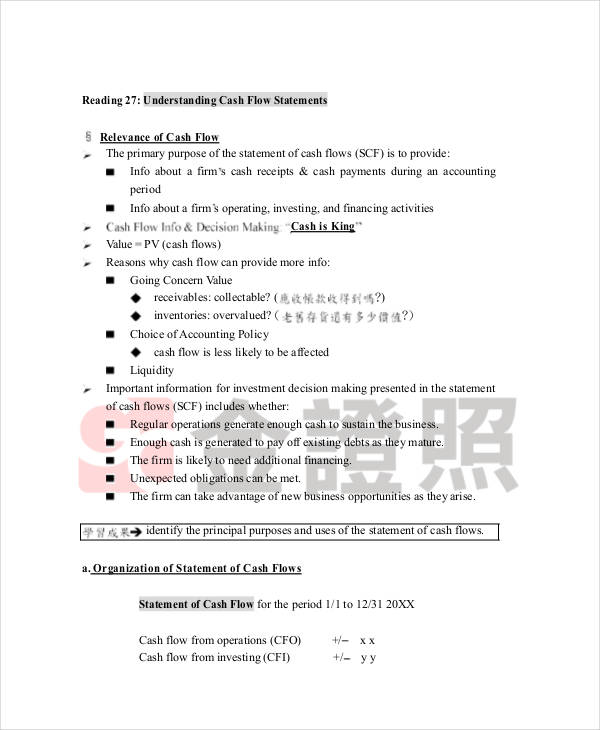

Cash Flow Statement 27 Examples Format Pdf Examples

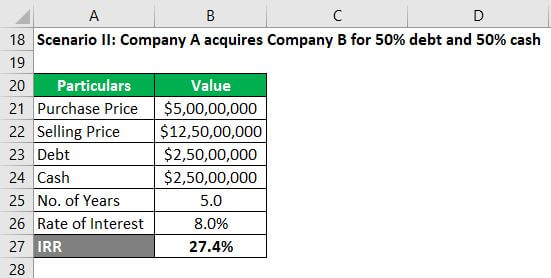

Leveraged Finance Effects Of Leveraged Finance With Example

27 Apps That Pay You Real Money Make Easy Money Online

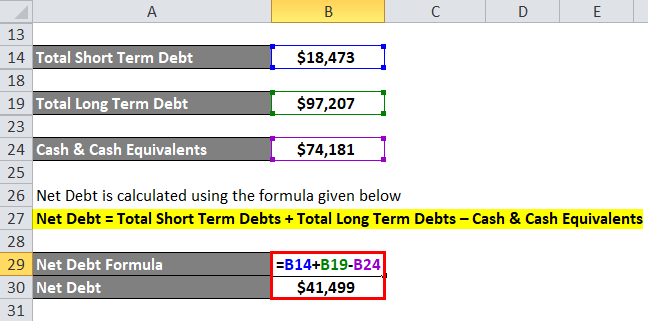

Net Debt Formula Calculator With Excel Template

Learn Excel Shortcuts Archives Brad Edgar

Cash Flow Statement 27 Examples Format Pdf Examples

27 Sponsorship Proposal Template Sample Letter Sponsorship Proposal Template Seo Marketing Sponsorship Proposal Event Sponsorship Donation Letter

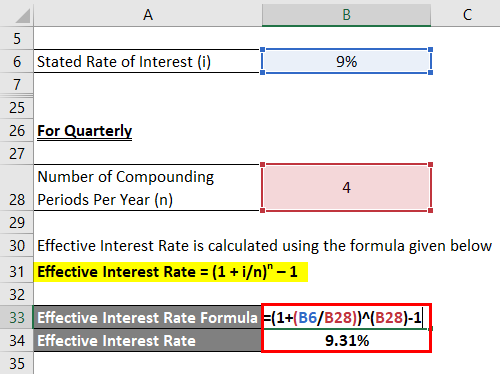

Effective Interest Rate Formula Calculator With Excel Template

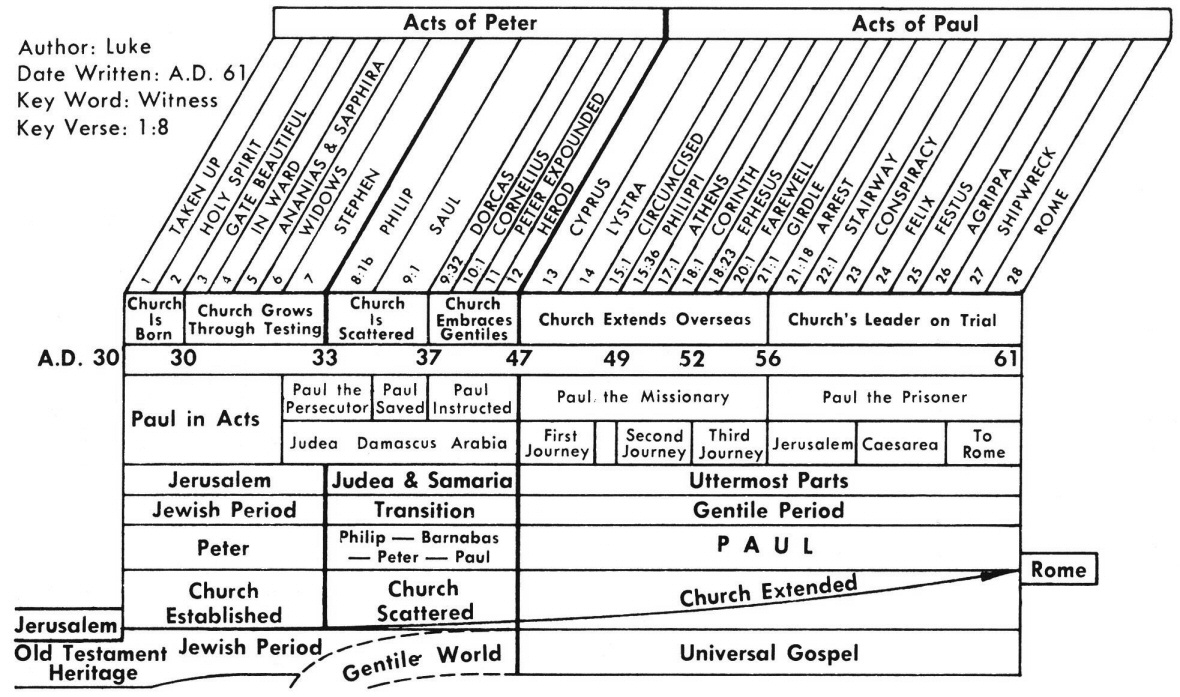

Acts 8 Commentary Precept Austin

Learn Excel Shortcuts Archives Brad Edgar

100 Ways To Save Money On A Tight Budget In 2019 Are You Struggling To Save Money Do You Want To Increase The Am Saving Money Ways To Save Money Money Frugal

Slide 006 Jpg

Pin On Elevacity